LOCAL OPTION SALES TAX RESOURCE GUIDE

Effective April 1, 2019

HOW WILL THE LOCAL OPTION SALES TAX FOR TRANSPORTATION BE COLLECTED?

Businesses within Redwood County will collect an additional .5% sales tax on items/services subject to sales tax.

Example: On a $1,000 purchase, an additional $5 would be collected.

Per Minnesota Statute 297A.99, Subdivision 11, the tax must be remitted to the county by the state at least quarterly.

The state is entitled to recover administrative costs for collection. These are taken out of the collections by the state prior to payment so there is no additional transaction between the state and the county.

HOW CAN COUNTIES USE THE LOCAL OPTION SALES TAX FOR TRANSPORTATION FUNDS?

The tax may only be used for the following purposes:

Payment of the capital cost of a specific transportation project or improvement;

Payment of the costs, which may include both capital and operating costs, of a specific transit project or improvement;

Payment of the capital costs of safe routes to school program under section 14.4.; or Payment of transit operating costs.

Sales tax does not apply to purchases of vehicles.

The taxes must terminate when revenues raised are sufficient to finance the project, except for taxes for operating costs of a transit project or improvement, or for transit operations.

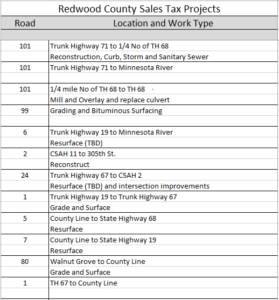

TRANSPORTATION PROJECTS

BUSINESS OWNER RESOURCES

Small seller exemptions per state to include compliance date, thresholds, guidance for remote sellers and press releases

Contact information for each state regarding sales tax

Sales tax rates look up based on location h

https://taxmaps.state.mn.us/salestax/ https://www.revenue.state.mn.us/businesses/sut/Documents/Local_Tax/Local_Tax_Rate_Guide.pdf https://www.revenue.state.mn.us/businesses/sut/Pages/Local_Tax_Info.aspx

MN Department of Revenue Local Option Sales Tax

https://www.revenue.state.mn.us/businesses/sut/factsheets/FS164.pdf

CONTACT INFORMATION

Streamlined Sales Tax Governing Board - Minnesota Phone: (800) 657-3777

Email: [email protected]